Algorithmic Trading: An Introduction for Retail Investors

The stock market has evolved dramatically with the rise of technology, and algorithmic trading stands as a pivotal force in modern financial markets. For retail investors navigating investing and trading landscapes, understanding algorithmic trading—commonly known as "algo trading"—is crucial for informed decision-making. This automated approach uses computer programs to execute trades based on predefined criteria, influencing stock trading dynamics and market analysis. Unlike manual methods, algos operate at speeds and volumes unattainable by humans, shaping investment strategies across the board. This article offers an educational overview of algorithmic trading, focusing on its mechanics, institutional applications, and key awareness points for retail participants. By comprehending its impact, you'll better align your portfolio management with economic trends and enhance risk management in volatile environments.

Algorithmic trading boosts efficiency in financial markets by increasing liquidity and refining price discovery, which benefits the overall stock market ecosystem. For retail investors, awareness of algos provides insights into market behaviors, helping you anticipate movements and avoid common pitfalls in trading. Let's explore the fundamentals to empower your understanding of this transformative tool in investing.

What Is Algorithmic Trading?

Algorithmic trading refers to the use of sophisticated computer algorithms to automate the buying and selling of securities in financial markets. These programs follow coded instructions based on variables like price, timing, volume, or economic trends, executing trades in fractions of a second. At its core, algo trading minimizes human error and emotion, relying instead on data-driven market analysis.

Institutions dominate algo trading, deploying it for large-scale operations where precision and speed are paramount. For example, an algorithm might scan multiple exchanges for arbitrage opportunities, buying low on one platform and selling high on another instantaneously. Retail investors should be aware that while algos drive much of the stock market's daily volume—often over 70%—they can create rapid price swings that affect individual trading positions.

- Example: During periods of high market activity, algorithms might amplify a stock's upward trend by triggering mass buys based on positive momentum signals.

- Awareness Tip: Recognize that algos react to data feeds, so sudden news can lead to automated sell-offs, impacting your portfolio management unexpectedly.

How Institutions Use Algorithmic Trading

Institutions like hedge funds, banks, and asset managers leverage algorithmic trading to handle vast portfolios efficiently. They employ algos for strategies such as high-frequency trading (HFT), where trades occur in microseconds to capitalize on tiny price discrepancies. This institutional dominance in stock trading allows for better risk management, as algos can diversify across thousands of assets while monitoring economic trends in real-time.

For instance, institutions use volume-weighted average price (VWAP) algorithms to execute large orders without disrupting market prices, breaking them into smaller trades over time. This approach maintains anonymity and minimizes slippage. Retail investors should note how this institutional use influences financial markets, often leading to tighter spreads but also potential flash crashes if multiple algos align in panic selling.

- Key Institutional Applications:

- Scalping: Profiting from small, frequent price changes through rapid trades.

- Pairs Trading: Betting on the convergence of correlated assets, like two stocks in the same sector.

- Iceberg Orders: Hiding large order sizes to avoid tipping off the market.

- Example: A pension fund might use an algo to rebalance its holdings quarterly, automatically adjusting based on predefined investment strategies to align with long-term goals.

The Impact of Algorithms on Financial Markets

Algorithms profoundly shape financial markets by enhancing liquidity and efficiency, but they also introduce complexities. On the positive side, algos facilitate smoother trading by providing constant buy/sell activity, which narrows bid-ask spreads and aids price discovery. This benefits the stock market overall, as it reflects economic trends more accurately and quickly.

However, retail investors must be aware of downsides, such as increased market volatility from algo-driven events. For example, correlated algorithms can exacerbate downturns, leading to rapid cascades. Understanding this helps in market analysis, allowing you to interpret sudden movements as algo-induced rather than fundamental shifts.

| Aspect |

Pros |

Cons |

| Liquidity |

Increases trading volume for easier transactions |

Can withdraw suddenly in crises, drying up markets |

| Price Efficiency |

Rapid adjustments to new information |

Overreactions to false signals amplify errors |

| Volatility |

Dampens minor fluctuations through arbitrage |

Heightens short-term swings via herd behavior |

| Accessibility |

Lowers costs for all participants |

Advantages institutions over retail in speed |

- Awareness Tip: Monitor economic indicators that trigger algos, like interest rate changes, to anticipate potential volatility in your investing.

Key Risks and Challenges for Retail Investors

While algorithmic trading is largely institutional, retail investors face indirect risks from its prevalence. One major concern is market manipulation potential, where algos might spoof orders—placing and canceling bids to mislead others. This affects stock trading fairness and requires vigilance in risk management.

Additionally, algos can create information asymmetry; institutions access superior data feeds, leaving retail traders reacting to outdated info. Be aware of "flash crashes," where algo errors cause temporary plunges, offering buying opportunities but also traps for the unprepared.

- Example: In a volatile session, an algo glitch might trigger a sell-off in a sector, allowing savvy retail investors to buy undervalued stocks once stability returns.

- Tips for Awareness:

- Use limit orders instead of market orders to avoid slippage from algo-driven price jumps.

- Diversify your portfolio management to buffer against algo-induced sector swings.

Strategies for Retail Investors to Navigate Algo-Dominated Markets

Smart retail investors adapt by focusing on awareness rather than competition with algos. Emphasize long-term investment strategies that algos overlook, like value investing based on fundamentals rather than short-term trading signals. Incorporate market analysis tools to spot algo patterns, such as unusual volume spikes indicating institutional activity.

For risk management, set personal rules like position sizing and stop-losses to counter algo volatility. Stay informed on economic trends that influence algo behavior, enabling proactive adjustments in financial markets.

- Navigation Tips:

- Focus on after-hours analysis when algos are less active for clearer insights.

- Join communities or use apps that highlight potential algo impacts on stock market moves.

- Example: If algos drive a stock's price up on hype, a retail investor might wait for reversion, buying at a more reasonable valuation post-correction.

Conclusion: Building Awareness in an Algo-Driven World

Algorithmic trading represents a cornerstone of modern financial markets, primarily wielded by institutions to optimize stock trading and portfolio management. For retail investors, education on algos fosters better investing decisions, highlighting how they enhance market efficiency while posing risks like volatility. By understanding institutional uses and staying alert to their effects, you can refine your market analysis, risk management, and alignment with economic trends.

Approach the stock market with informed caution, prioritizing long-term strategies over reactive trading. This knowledge empowers you to thrive amid algo influences, always remembering to consult professionals for tailored advice. With these insights, navigate financial markets more confidently as a retail participant.

WEEK IN REVIEW

Weekly Market Overview (October 10, 2025)

A dramatic week in financial markets saw stock market news dominated by President Trump's renewed tariff threats on China, prompting a pronounced spike in market volatility and sharp sector rotations. The S&P 500, Nasdaq, and Dow each posted notable losses after a streak of record highs, reflecting trader anxiety over the global market outlook and investment opportunities going forward.

Major Indices & Numbers

- S&P 500: Fell to 6,629, down approximately 2.7% for the week, following Friday’s steep selloff triggered by tariff headlines—a notable shift after setting new record highs midweek.

- Dow Jones Industrial Average: Dropped more than 850 points on Friday, finishing the week 1.9% lower as global trade risks increased.

- Nasdaq Composite: Ended down 2.2% for the week, hit hardest due to sector exposure and ongoing rare earths and technology trade tensions.

- Volatility Index (VIX): Jumped above 22, highlighting a decisive pickup in market volatility as Wall Street news analyzed potential supply chain disruptions and inflation risks.

Trump’s Tariff Policy: Market Impact

President Trump’s announcement of a “massive” tariff increase on Chinese imports, following China’s new curbs on rare earth exports, was a catalyst for the market correction, with implications for corporate profitability, supply chains, and investor risk appetite. Technology stocks, semiconductors, and manufacturing were particularly affected, as traders reassessed their stock trading strategies and closely followed trading signals for potential sector reallocations.

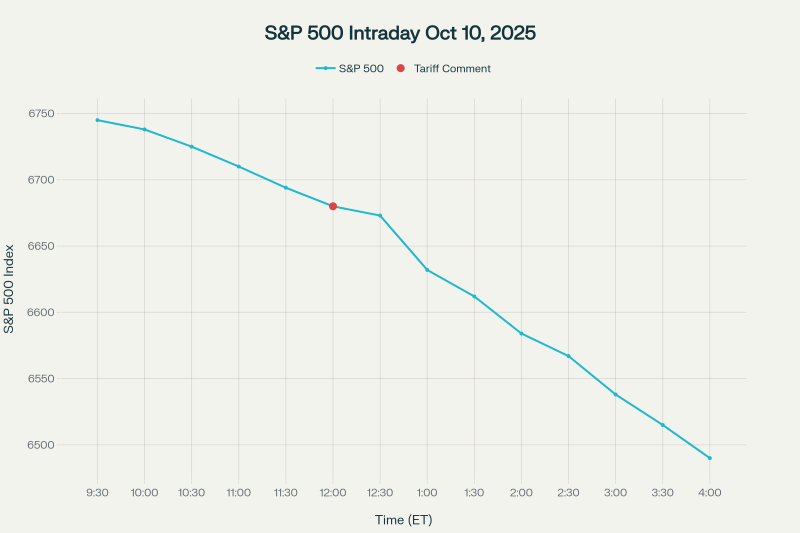

Today's Selloff: S&P 500 Intraday

The chart above shows the S&P 500’s steep decline after Trump’s midday tariff remarks, with sharp market reaction as comments were reported.

Macro & Sector Highlights

- Technology: Led declines as tech earnings outlooks dimmed due to tariff fears; companies with global supply chains saw swift valuation adjustments.

- Industrials/Materials: Suffered early losses before rebounding on U.S. rare earths demand optimism, providing select investment opportunities for tactical traders.

- Utilities/Consumer Staples: Outperformed defensively amid heightened uncertainty; market analysis showed renewed sector rotation as traders sought safer assets.

- Energy: Dropped modestly with softer global growth expectations and commodity price swings.

Economic Indicators & Outlook

With much official data delayed by the ongoing government shutdown, private surveys and Wall Street forecasts guided investor sentiment. The economic calendar this week focused on inflation readings and Fed commentary, with bond yields slipping as risk aversion set in.

As Q4 begins, the US stock market today faces elevated uncertainty from trade disputes, policy headlines, and global growth risks. Market trends for 2025 may hinge on the resolution of tariff issues and signs of broadening economic recovery. For now, trading strategies are favoring defensive sectors, technical analysis stocks signal caution, and investors await clear financial news analysis for guidance on the best stocks to buy now.

Understanding the Stock Market: Key Concepts for New Investors

Learn essential stock market basics, from economic indicators to trading strategies, to make smarter investment decisions.

The stock market can seem like a complex web of numbers, trends, and jargon, but at its core, it's a gateway to building wealth and participating in the global economy. For new investors, grasping the fundamentals is crucial to making informed decisions. Whether you're tracking stock market news or seeking financial market insights, understanding key concepts like market analysis and stock trading strategies can demystify the process.

This guide breaks down essential ideas, offering actionable advice to help you navigate investment opportunities with confidence. By focusing on evergreen principles, you'll gain stock market insights that stand the test of time, regardless of short-term fluctuations.

What Is the Stock Market and How Does It Work?

The stock market is essentially a marketplace where buyers and sellers trade shares of publicly owned companies. It's influenced by supply and demand, with prices fluctuating based on company performance, investor sentiment, and broader economic factors.

For instance, when positive stock market predictions emerge from strong earnings reports, prices may rise, creating investment opportunities. Key to this is understanding indices like the S&P 500, which tracks 500 large U.S. companies and serves as a benchmark for market health.

Tip for Beginners: Start small by investing in index funds that mirror the S&P 500 to gain exposure without picking individual stocks.

Essential Economic Indicators Every Investor Should Know

Economic indicators are vital signals that influence financial news analysis and guide trading decisions. These include GDP growth, unemployment rates, inflation, and interest rates, which collectively shape the global market outlook.

| Indicator |

Pros |

Cons |

| GDP Growth |

Signals economic expansion, boosting stocks |

Lagging indicator; doesn't predict downturns |

| Unemployment Rate |

Low rates indicate strong consumer spending |

Can be misleading in gig economies |

| Inflation |

Moderate levels encourage investment |

High inflation erodes purchasing power |

| Interest Rates |

Low rates make borrowing cheap for growth |

High rates can slow economic activity |

Market Analysis Techniques: Fundamental vs. Technical

Market analysis is the backbone of successful investing and trading, dividing into fundamental and technical approaches. Fundamental analysis evaluates a company's intrinsic value through financial statements, earnings, and management quality. Technical analysis, on the other hand, focuses on price patterns and historical data to forecast movements.

- Practice technical analysis with demo accounts before trading live.

- Balance both methods: Use fundamentals for long-term investments and technicals for short-term trades.

Developing Effective Stock Trading Strategies

Stock trading strategies range from day trading to long-term investing, each suited to different risk tolerances. A buy-and-hold strategy involves purchasing quality stocks and retaining them to capitalize on compound growth over time. Diversification is another key approach—spread investments across sectors to mitigate risk.

- Set clear goals: Income (dividends) or growth (capital appreciation).

- Use stop-loss orders to manage risk.

- Incorporate technical trading signals for timing entries and exits.

Navigating Market Volatility and Risk Management

Market volatility refers to the rapid price swings that can unsettle investors, but it’s a natural part of the market cycle. Effective risk management includes proper asset allocation, diversification, and using tools like options to hedge positions.

- Build an emergency fund covering 6–12 months of expenses before investing.

- Rebalance your portfolio regularly to maintain your desired risk levels.

- Stay informed, but avoid emotional trading decisions.

Conclusion: Empowering Your Investment and Trading Journey

Mastering the stock market requires patience, education, and discipline. From decoding economic indicators to applying effective trading strategies, the concepts covered here form a strong foundation for new investors. Always prioritize learning over speculation and let your journey toward financial independence begin today.

© 2025 Tradespot24 · All Rights Reserved

WEEK IN REVIEW

Weekly Market Overview (October 3, 2025)

The U.S. equity market extended its record-setting advance this week despite headwinds from a government shutdown, persistent inflation, and fresh global trade tensions. Major indices set new all-time highs, supported by robust corporate earnings and the enduring AI boom.

U.S. Indices and Performance

- S&P 500: Closed at 6,715.35 (all-time high; +3.5% in September, +14% YTD).

- Dow Jones: 46,519.72 (+0.2%)

- Nasdaq Composite: 22,844.05 (+0.4%)

- Russell 2000: First record close since 2021

Macro Environment & Key Drivers

- Government Shutdown: Markets unfazed as shutdown expected to have modest impact.

- Fed Pivot: September rate cut, with more likely in 2025 (target: 4.00%-4.25%), lifts risk appetite.

- Earnings: Double-digit S&P 500 EPS growth projected into 2026; tech & AI outshine peers.

Sector Performance Breakdown

- Technology: 31.6% S&P weighting; up 14.6% YoY, slight pause after AI run.

- Financials: 14.3% S&P; up 26.1% YoY on strong lending and rates.

- Consumer Discretionary: +21.7% YoY.

- Energy: Down -7.3% YoY.

- Health Care: Pharmaceuticals up 9.3% weekly, breaking out of downtrend.

- Utilities, Industrials: Double digit annual gains, infrastructure growth boost.

- Emerging Markets: MSCI EM Index +7.2% September, outpaced developed markets (+1.9%).

Bond Market Developments

- Bloomberg US Agg. Bond Index: +1.1% in September as 10Y yield dipped to 4.16%.

- 2Y Treasury: Rose to 3.64%; curve flattened after strong economic data.

- Corporate Bonds: -0.4% weekly as spreads widened; $54B in new supply.

- Municipals: Yields up slightly; new supply $7.8B, demand resilient.

Economic Data and Macro Highlights

- Inflation: Core PCE 2.9% YoY (Fed target: 2%).

- GDP: Q2 revised higher to 3.8% (annualized).

- Jobs: Growth moderated; consumer spending resilient.

Cryptocurrency & Alternatives

- Bitcoin: $124,000 (12% weekly, +29% YTD).

- Ethereum: $4,400+.

Outlook

- Short-term volatility likely, but AI innovation, strong earnings, and lower rates sustain optimism.

- Projections put S&P 500 near 8,000 by 2026 if current conditions persist.